Have you ever wondered about the affordability of homes in different areas? In our study, we use the term “house rich” to describe places where homeownership is dominant and homes are relatively affordable compared to the local median income.

From bustling cities in the Midwest to sunny spots on the West Coast, some places stand out due to affordable housing and high homeownership rates.

But what causes a place to be house rich, and how does the typical home in every state measure up to this benchmark? All Star Home analyzed the latest numbers from the U.S. Census Bureau, breaking down the data and sharing the surprising places where homes are affordable and homeownership rates are high.

Key Findings

- West Virginia, Iowa, and Michigan are the top house rich states.

- Davie, North Carolina, is the most house-rich city in the entire U.S.

- Americans are the least house rich in California.

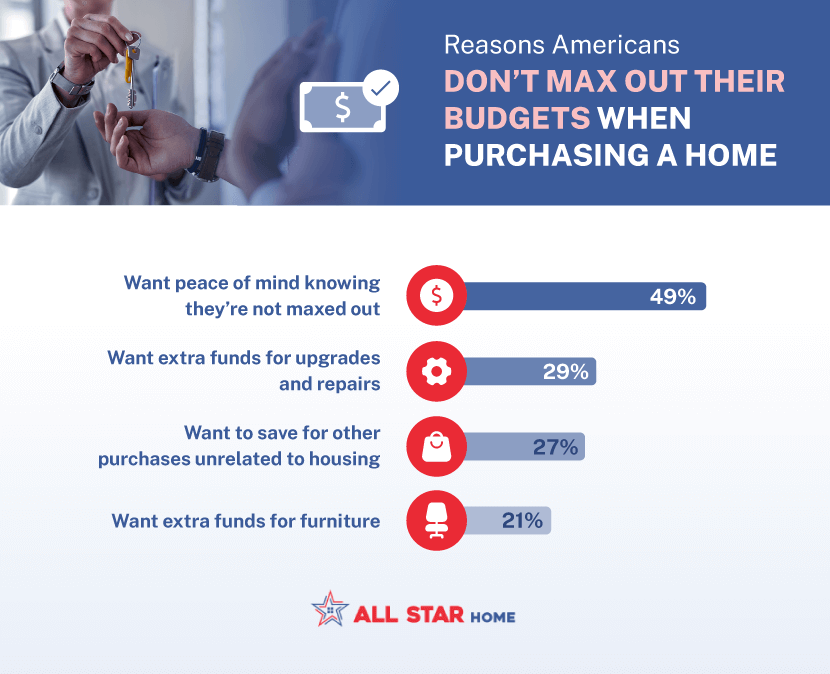

- Almost half (49%) of Americans stay right on budget when buying a home.

What Does “House Rich” Mean?

Using comprehensive data from the Census, we developed a “house rich” score for each state. First, we compared the median value of owner-occupied housing units and the median household income, yielding a home-value-to-income ratio.

Then we incorporated the owner-occupied housing unit rate into our calculations to adjust the ratio. By multiplying the home-value-to-income ratio with the non-owner occupied housing rate, we gauged the dominance of homeownership in every locale.

A low score indicates that a location is house rich, wherein housing is not only affordable but also where a majority of the populace reside in homes they own.

Additionally, we conducted a survey in which we found that while nearly half of Americans (49%) managed to stay within their budget during a home purchase, a noteworthy 30% say they exceeded their financial limits, albeit slightly.

So we wondered what drives the financial decisions of homebuyers? Our research points to peace of mind being the paramount reason. Many Americans are unwilling to stretch their budgets to the brink, seeking stability over extravagance.

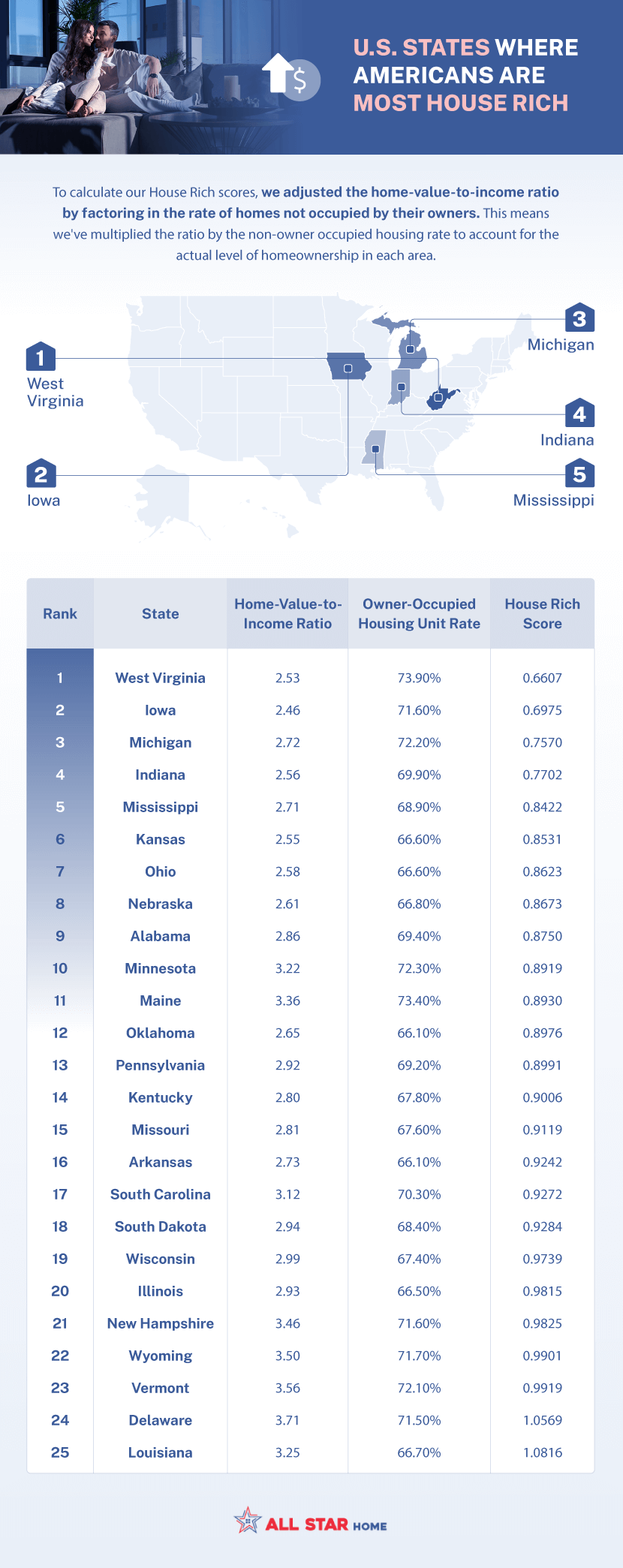

The Most House Rich States in America

The title of the most house rich states in America goes to West Virginia, Iowa, and Michigan. This means that housing is more affordable and a large percentage of the population are homeowners.

For context, let’s look at nationwide metrics. The median home-value-to-income ratio across America is 3.33. Additionally, about two-thirds of the nation’s housing units (66.75%) are owner-occupied. High-ranking states like West Virginia are both more affordable (2.53) and have a higher owner-occupancy rate (74%).

But West Virginia is not alone in this trend. Midwestern states like Iowa, Michigan, and even Indiana are carving a niche for themselves in the house rich category.

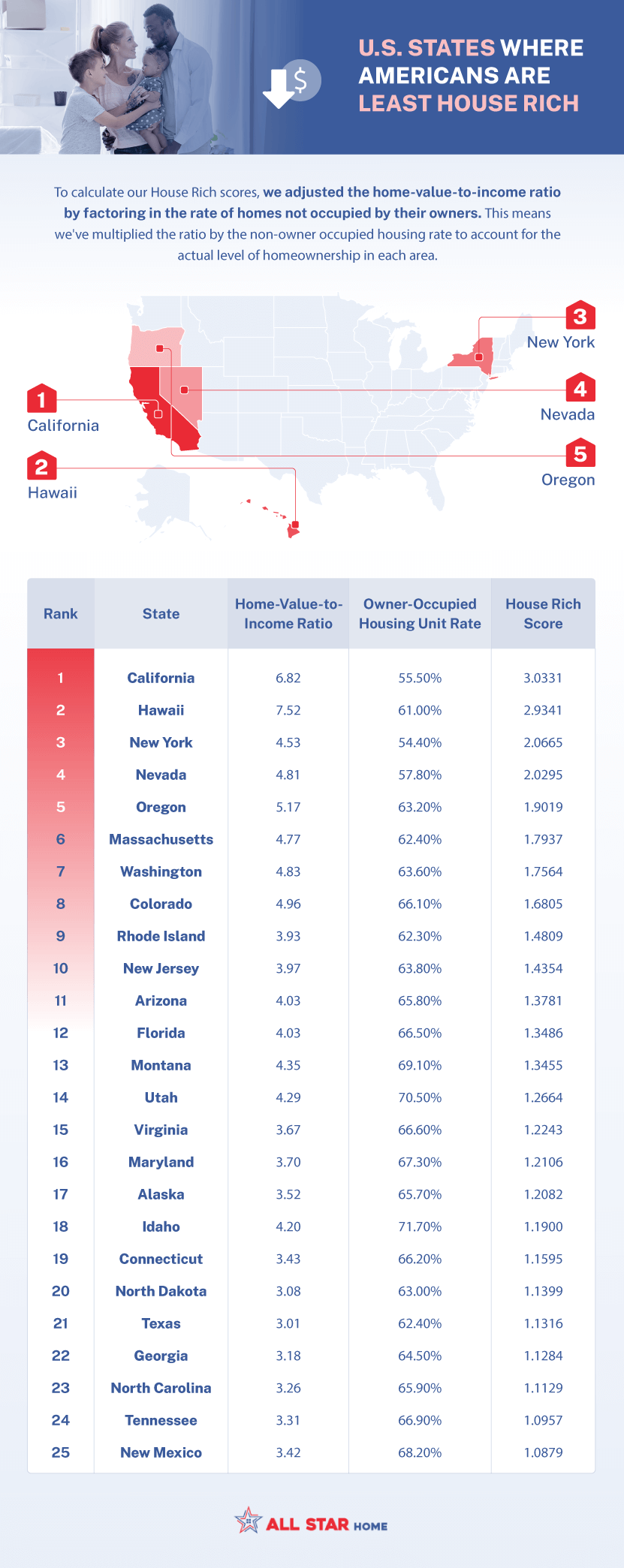

The Least House Rich States in America

It’s no surprise that the least house rich states are those with very high costs of living — California, Hawaii, and New York. While these states might be brimming with natural beauty and opportunities, homeownership remains an elusive dream for many due to the high costs associated.

A mere 56% of Californians are homeowners, only slightly more than New York’s 54%. And these states’ home-value-to-income ratios are abominable when compared to the national average (3.33). California sits at 6.82, Hawaii at 7.52, and New York at 4.53.

Furthermore, states at the lower end of this ranking, such as Washington, Oregon, and California, are celebrated for their bustling urban centers and tech hubs. This affiliation hints at a possible recent housing boom fueled by the tech industry and other sectors.

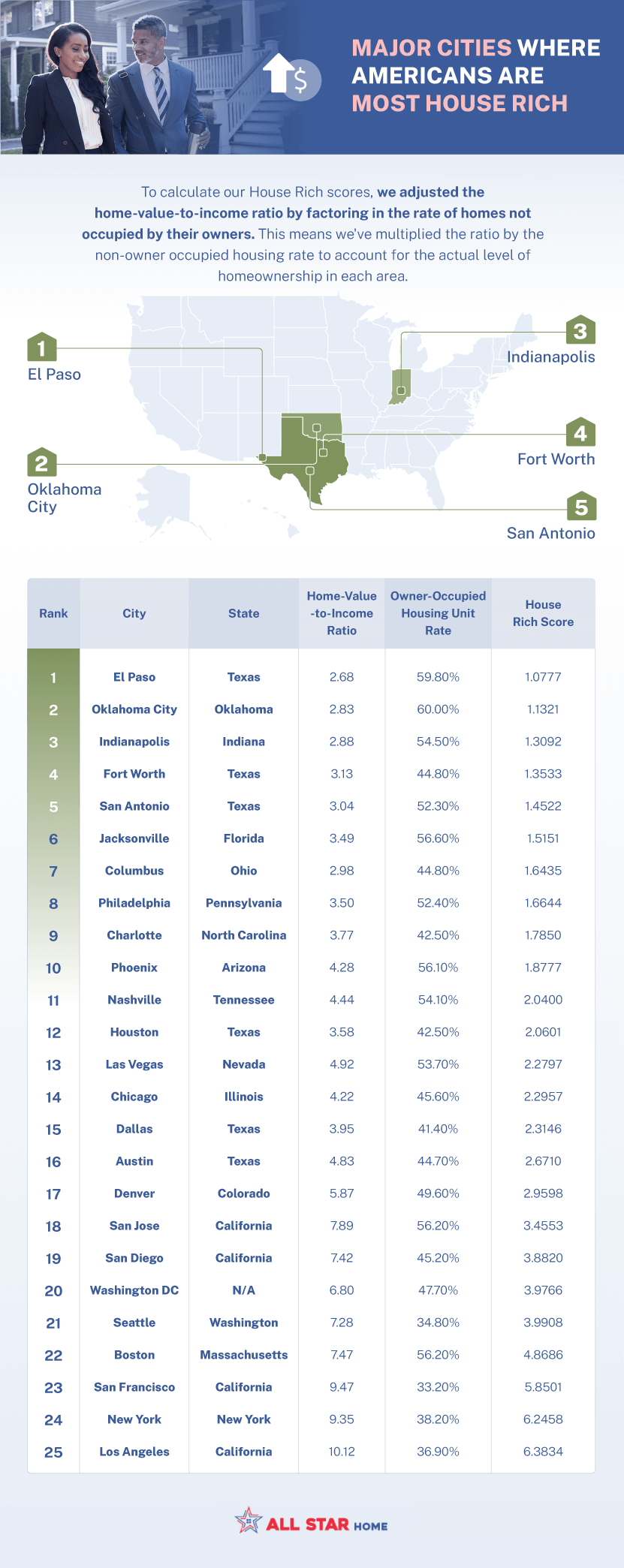

El Paso Claims Spot for Most House Rich Major City

In a quest to discover which of the U.S.’s major cities are most house rich, we conducted another analysis, zeroing in specifically on the 25 most populated cities. Emerging triumphantly at the top are El Paso, followed by Oklahoma City, and Indianapolis. Interestingly, these top-ranking cities predominantly hail from the Midwest and South.

In contrast, cities renowned for their flourishing tech industries and high cost of living — San Jose, San Francisco, and Seattle — find themselves at the opposite end of the spectrum. While one might assume that the lucrative salaries synonymous with the tech world would make these cities more house rich, the reality is opposite. Even though median incomes in these tech-heavy cities are substantial, the astronomic home values still dwarf these earnings.

Sunbelt cities, such as Phoenix, Las Vegas, and Nashville, find themselves nestled in the middle of our list. Given the Sunbelt’s explosive growth and urbanization in recent years, it’s fascinating to observe how these dynamics might be influencing its house rich stature.

Peering deeper into homeownership rates for our major cities, New York City emerges with the lowest owner-occupied housing rate, at a mere 33%. In stark contrast, Oklahoma City boasts the highest rate, with 60% of its homes being owner-occupied.

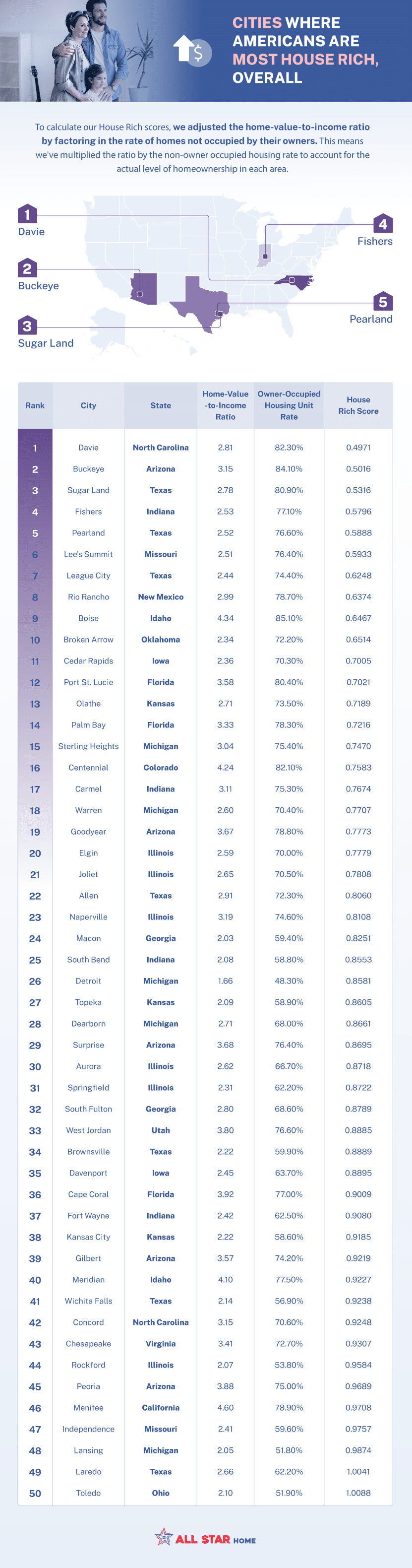

Davie, North Carolina Is the Most House Rich City Overall

In the nationwide race to determine which city can be termed the most house rich, Davie, North Carolina has emerged as the gold standard. Following close behind are Buckeye, Arizona and Sugar Land, Texas.

A closer look at the list reveals a prevalent trend: the rise of the suburbs. Cities like Sugar Land, Pearland, and League City, all nestled in Texas, are prominent features on this list.

Echoing the trends seen in state lists, a significant portion of these house rich cities hail from the Midwest, showcasing the region’s consistent performance in housing value relative to income and ownership status.

An interesting outlier in the data is Boise, Idaho. This city boasts an exceptionally high owner-occupied housing unit rate of 85%, indicating a robust culture of homeownership and possibly contributing to its house rich status.

Maintain the Value of Your Home

Maintaining and enhancing the value of your home goes beyond understanding its relative affordability in the market. To truly preserve, and even increase its worth, continuous care and attention to your property are paramount.

A well-maintained home not only holds its value but can also appreciate over time, strengthening its position in a ‘house rich’ environment. Regardless of where your state ranks in housing affordability, proactive upkeep is a pivotal commitment in protecting and growing your investment.

This is where All Star Home steps in. We believe that taking care of your home shouldn’t strain your finances. Our affordable range of services ensures that maintenance becomes an investment in value retention and growth, rather than an additional expense. From clearing gutters to urgent roof repairs, All Star Home’s dedicated team is poised to provide top-notch services without undue financial stress.

Your home is not just a financial asset; it’s a reflection of who you are. Ensure it mirrors the best version of you, both in value and appearance, with All Star Home.

Methodology

In October 2023, we sourced the most recent data from the United States Census Bureau to understand which locations in the U.S. are characterized as “house rich.” For our purposes, being “house rich” is defined by areas with a low home-value-to-income ratio and high rate of owner-occupied housing.

An important element in our analysis was the consideration of the owner-occupied housing rate. This rate gauges the percentage of homes that are occupied by their owners, as opposed to being rented out or vacant. We factored in this rate to ensure our analysis captured places where not only homes are valued highly in relation to income but also where homeownership is prevalent.

Additionally, we conducted a survey involving 1,997 Americans. Our objective was to determine how many individuals adhere to their budget when purchasing homes and to understand the key reasons behind Americans choosing not to stretch their budgets to their limits.

By melding insights from our survey with the Census Bureau data, we aimed to offer a comprehensive analysis of the regions in the U.S. where Americans are most “house rich” and where they are least.